Why a 10-Year Head Start Beats Decades of Catch-Up

Many people assume they can start saving later and make up for it by contributing more. The math says the head start usually wins.

How compounding builds advantage

Compound interest means you earn returns on your returns, not just on what you originally put in. Your money grows, then that larger amount grows, and so on. Over decades, the effect is dramatic.

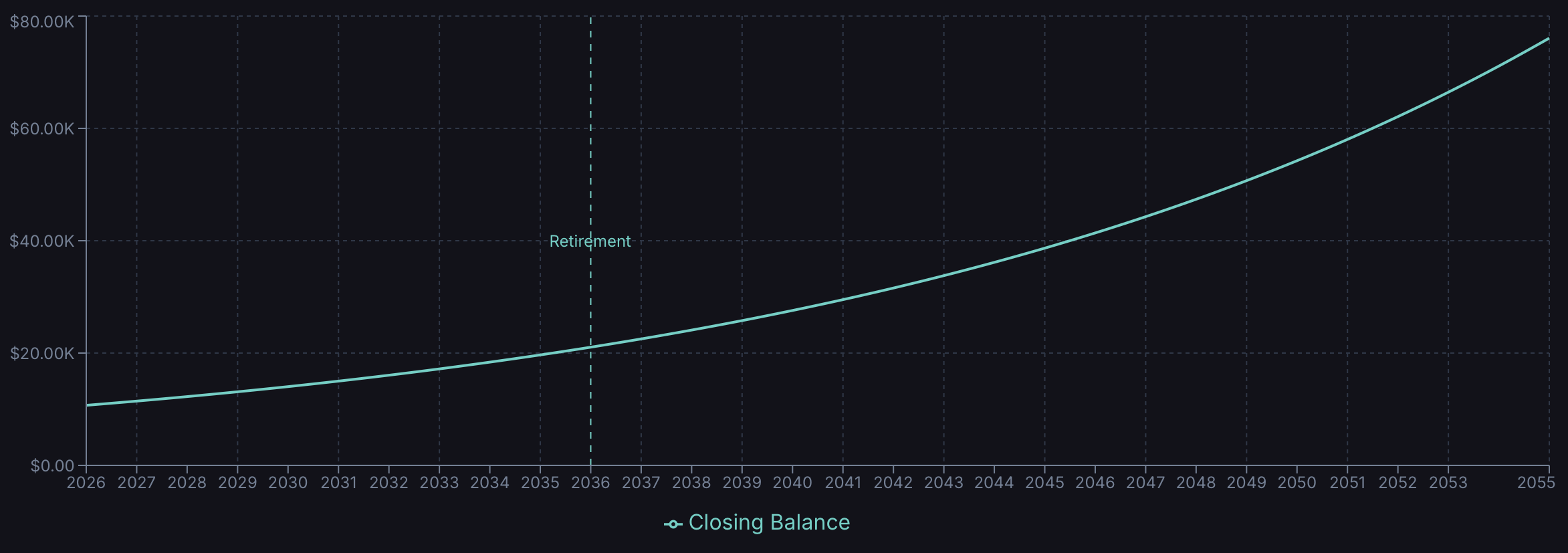

Say you invest $10,000 at 7% annual returns:

- After 1 year: $10,700 (you made $700)

- After 10 years: $19,672 (nearly doubled)

- After 30 years: $76,123

That last decade alone added about $40,000. Same investment, same rate. The growth just accelerates as the base gets bigger.

The head-start effect

Here's a thought experiment that shows why timing overwhelms effort:

Person A starts at 25, invests $5,000/year for just 10 years, then stops completely. Total invested: $50,000.

Person B starts at 35, invests $5,000/year for 30 years. Total invested: $150,000.

At a constant 7% annual return, Person A ends up with roughly $563,000. Person B ends up with about $505,000.

Person A invested a third of the money and came out ahead. The 10-year head start was worth more than 20 extra years of contributions.

The range behind the average

A steady 7% return is a simplification. Real returns arrive in uneven bursts, which means the same plan can end in a wide range of balances. A 1% change in assumed return or a few years of delay compounds into hundreds of thousands by retirement.

Pathwyze is built to show this with your own data: compare two starting ages and see how the range of outcomes shifts.

See what this looks like with your numbers; start your plan.